tax credit community meaning

Owners and investors in qualified affordable multifamily residential developments can use the housing tax credits as a dollar-for-dollar reduction of federal income tax liability. Tenants living in tax credit buildings have good cause eviction protection statewide.

3 Tax Credit Eviction.

. To ensure children receive the highest standards of education and to prepare them for the future. Regardless of background affiliation or religion. LIHTC owners are prohibited from evicting residents or refusing to renew leases or rental agreements other than for good cause.

The Low-Income Housing Tax Credit is a tax credit for real estate developers and investors who make their properties available as affordable housing for low-income Americans. It does not offer tax credits to the tenant renting the unit. Tax credits are dollar-for-dollar reductions of your tax bill.

Tax credits work well in todays community development environment. There are two types of Tax Credits. 713-587-5000 06 mi Directions.

End your tax stress today. The termination notice must state good cause and may include either a serious or repeated violation of the. It may also be a credit granted in recognition of taxes already paid or a form of state discount applied in certain cases.

The LIHTC was enacted as part of the 1986 Tax Reform Act and has been modified numerous times. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property owners. Residents of Alaska Tennessee and South Dakota can.

UNDERSTANDING TAX CREDIT COMMUNITIES This community is part of the Low-Income Housing Tax Credit LIHTC program. A tax credit differs from deductions and exemptions. Open community meetings offer an.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. This program is designed to offer affordable housing to only those individuals whom meet specific income requirements. Created by the Tax Reform Act of 1986 the LIHTC program gives State and local LIHTC-allocating agencies the equivalent of approximately 8 billion in annual budget authority to issue tax credits for the.

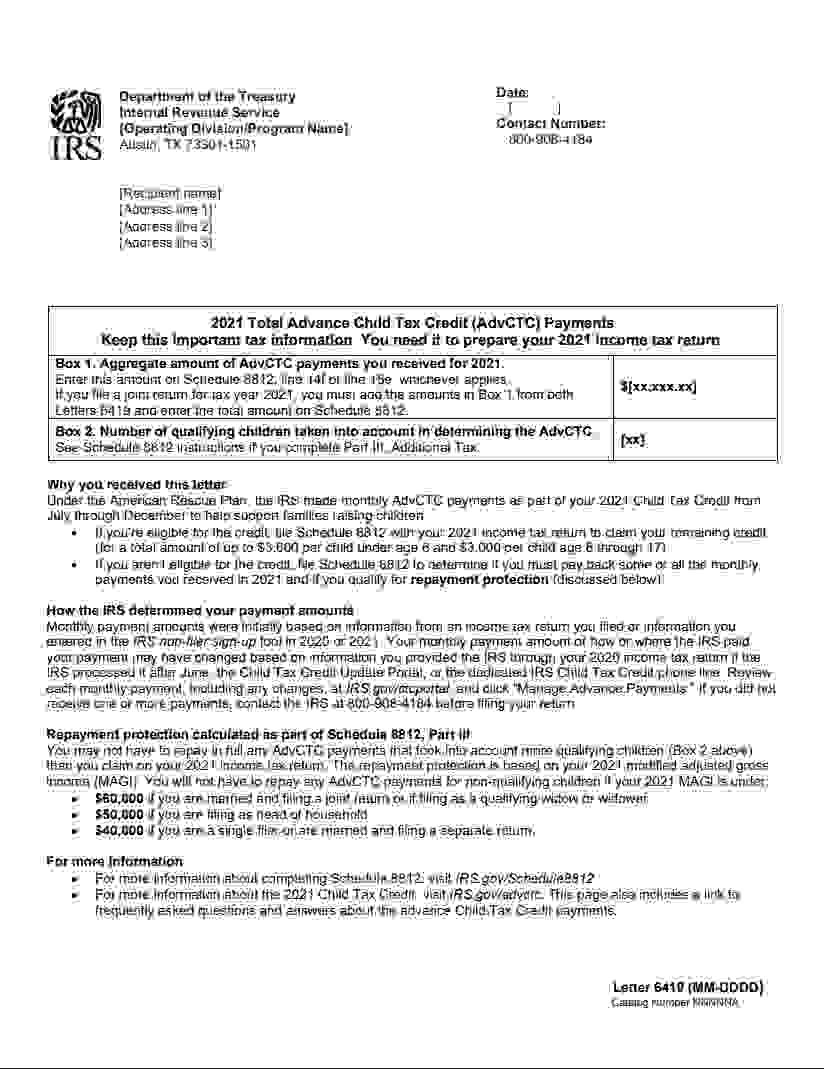

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to 17 years of age. Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar. Credits can be better than tax deductions because deductions only reduce your taxable income.

TAX CREDIT COMMUNITIES 2100 Memorial Drive Apartments 2100 Memorial Houston TX 77007 Phone. And give us a call. A tax credit property is an apartment complex or housing project owned by a developer or landlord who participates in the federal low-income housing tax credit LIHTC program.

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe. What Is a Tax Credit. That is they cannot reduce a filers tax liability below zero.

Most tax credits are nonrefundable but claiming some can result in the IRS sending you cash for anything thats left over after erasing your tax bill. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property owners. Dont let taxes impact your financial standing.

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe. Credits have the same value for everyone who can claim their full value. Nine states have community property laws that govern how married couples share ownership of their incomes and property.

A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. State housing agencies regulate the process to ensure only qualified residents may reside here. Community Tuition Grant Organization.

Tax credits are awarded to eligible participants to offset a portion of their federal tax liability in exchange for the production or preservation of affordable rental housing. That means that if you owe Uncle Sam 5000 a 2000 credit. The Low-Income Housing Tax Credit LIHTC program is the most important resource for creating affordable housing in the United States today.

Competitive 9 and Non-Competitive 4. When you work with Community Tax you get actionable advice from professionals you can trust at affordable rates. Its paid for by the federal government and administered by the states according to their own affordable housing needs.

LIHTC properties may contain market rate units that are not financially assisted in addition to reduced rent LIHTC. The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. A tax credit is a dollar-for-dollar reduction of the income tax you owe.

To provide low-income families with tuition assistance and to offset the cost of tuition for parents who would like the option of sending their child to the private school of their choice. Most tax credits are nonrefundable. The federal housing tax credit program is a means of directing private capital toward the creation of affordable rental housing.

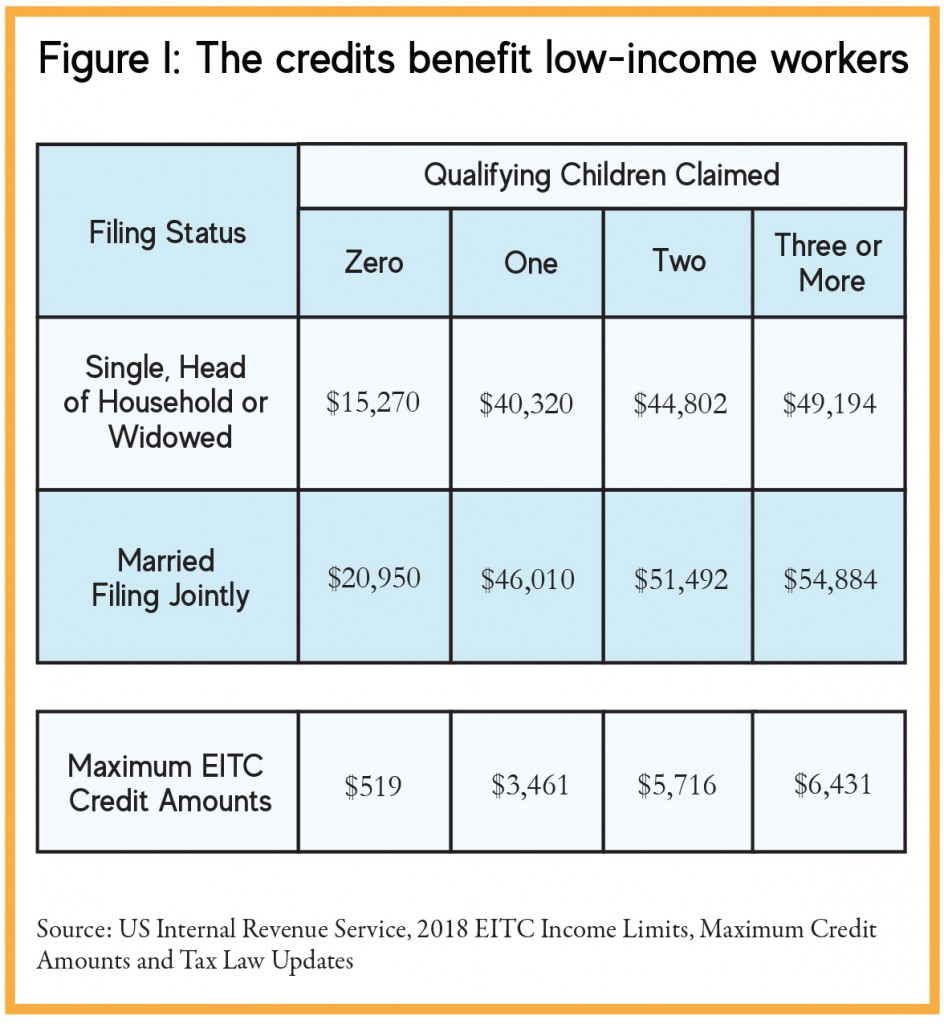

Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit exceeds your entire tax bill. Another way to think of a tax credit is as a rebate. Tax credits are subtracted directly from a persons tax liability.

The below information corresponds to the 9 Housing Tax Credit round which is highly. Community Tax was formed by attorneys and bankers with years of experience in both tax debt resolution and financial services. They therefore reduce taxes dollar for dollar.

Since the mid-1990s the LIHTC program has supported the construction or rehabilitation of about. It does not offer tax credits to the tenant renting the unit. Until a few years ago the promotion of community economic development in low-income areas had to be financed largely by.

1 These laws have a significant impact on their tax situations. LIHTC properties may contain market rate units that are not financially assisted in addition to reduced rent LIHTC. A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly.

A tax credit lowers the amount of money you must pay the IRS. As a result low-income filers often cannot receive the. These states are Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin.

For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero.

American Opportunity Tax Credit H R Block

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Employee Retention Tax Credit Office Of Economic And Workforce Development

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

What Are Tax Credits Turbotax Tax Tips Videos

Housing Tax Credit Program Lihtc Georgia Department Of Community Affairs

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Low Income Housing Tax Credit Ihda

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center