us japan tax treaty social security

An agreement with Japan. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced.

Social Security Name Change A Complete Guide For 2022 Marriage Name Change

March 23 2020 347 PM.

. I still live in. IRS International Taxation Overview. Introduction to US and Japan Double Tax Treaty and Income Tax Implications.

US Tax Treaty with Japan. It does not apply to a US Citizen or Permanent Resident. The country that receives.

Technical Explanation PDF - 2003. An agreement with Japan would save US. If you worked in the US.

2 Saving Clause and Exceptions. Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013. 3 Relief From Double Taxation.

US Tax Treaty with Japan. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Workers and their employers about 632 million in Japanese social security and health insurance taxes over the.

I have lived in Japan for more than 30 years. I have lived in Japan for more than 30 years. For less than 10 years you may be eligible for benefits in accordance with the US-Japan Social Security Agreement aka Totalization Agreement.

Individuals living abroad and. 1 US-Japan Tax Treaty Explained. During that time I worked at Japanese corporations and dutifully paid into Japans social security system.

Exemption on Your Tax Return. A minimum of 40 social security points or credits are required to. Social Security in Japan.

Protocol PDF - 2003. 4 Income From Real Property. Although the United States initially resisted pressures to revise the treaty over the course of the 1950s a.

Income Tax Treaty PDF - 2003. Americans who retire in Japan can still receive US social security payments if they qualify to receive them. Japans Ministry of Finance has published the synthesized text of the 1983 income tax treaty with China as impacted by the Multilateral Convention to Implement Tax Treaty Related Measures.

The US Japan tax treaty is useful for defining the terms for situations when it is unclear to which country taxes should be paid. On a yearly basis 70 of your pension plan distributions are taxable 7000 taxable amount divided by 10000 gross amount So.

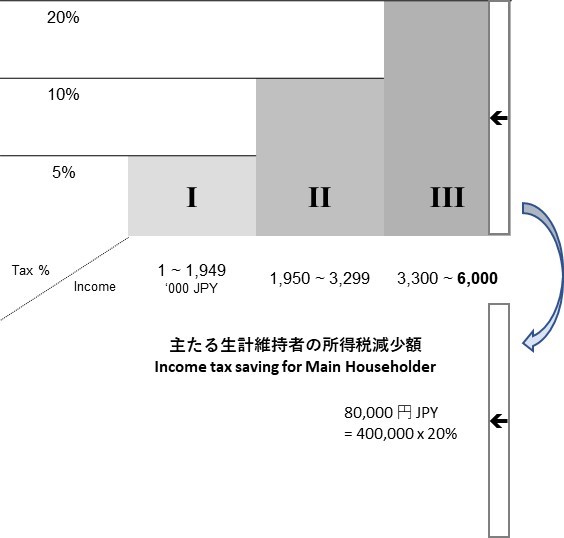

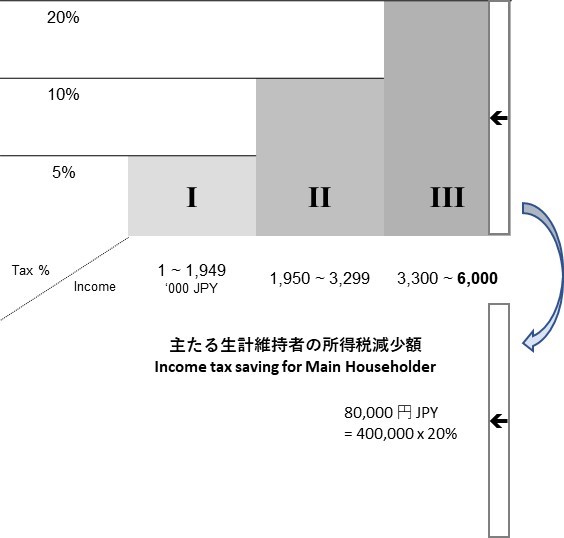

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

How Do Taxes Affect Income Inequality Tax Policy Center

/hand-holding-a-social-security-check-142900507-0a20f4ec7f4c406a8249d28437f2731a.jpg)

Can You Still Receive Social Security If You Live Abroad

Colin Gordon Income Share Of The Top 1 Percent 1913 2012 Annotated Annotation Percents Stock Market

Social Security Implications For Global Assignments Mercer

Social Security Totalization Agreements

Canada Tax Income Taxes In Canada Tax Foundation

/hand-holding-a-social-security-check-142900507-0a20f4ec7f4c406a8249d28437f2731a.jpg)

Can You Still Receive Social Security If You Live Abroad

Social Security Implications For Global Assignments Mercer

Easy Infographic Explains The Self Employment Tax For Americans Abroad Coworking Digitalnomad Remotework Ttot Tr Self Employment Infographic Digital Nomad

How Much Will I Get From Social Security If I Make 60 000 Nasdaq

How Do Taxes Affect Income Inequality Tax Policy Center

Do Expats Get Social Security Greenback Expat Tax Services

Social Security Benefits For Noncitizens Everycrsreport Com

How Do Taxes Affect Income Inequality Tax Policy Center

Can I Contribute To Social Security From Overseas